Nvidia Surpasses Microsoft and Apple to Become the World’s Most Valuable Company

Nvidia has made a meteoric rise to the top, becoming the world’s most valuable public company, outstripping even the tech behemoths Microsoft and Apple. On a remarkable Tuesday, Nvidia’s shares experienced a robust 3.5% surge, reaching an all-time high and closing at nearly $136. This surge in share price propelled the company’s market valuation to an extraordinary $3.34 trillion, allowing Nvidia to leapfrog Microsoft, which stood at $3.32 trillion, and Apple, recently valued at $3.28 trillion.

Founded in 1993 by the visionary trio of Jensen Huang, Chris Malachowsky, and Curtis Priem, the company initially carved out its niche in the tech world with its groundbreaking graphics processing units (GPUs) aimed primarily at the gaming market. However, the company’s ambition and innovation didn’t stop there. Over the years, the company has diversified its portfolio, expanding into areas such as professional visualization, data centers, and automotive technologies. The company’s relentless drive for innovation has placed it at the forefront of the artificial intelligence (AI) revolution, supplying the essential hardware that powers a vast array of AI applications. Its transformation from a niche player in gaming to a leader in AI technology is a testament to its strategic foresight and unwavering commitment to pushing the boundaries of technology.

Dominating the AI Chip Market

This journey began with a focus on high-performance graphics chips for the gaming industry, but the company has since evolved into a dominant force in the broader technology landscape, particularly in AI. Today, it controls approximately 80% of the AI chip market, especially those used in data centers—a sector experiencing explosive growth due to the increasing demand for AI-driven technologies. The business has flourished in this burgeoning sector, with its data center revenue soaring by an astonishing 427% year-over-year, reaching $22.6 billion in the most recent quarter. This segment now accounts for a substantial 86% of total sales, underscoring the company’s strategic pivot towards AI.

The AI revolution has generated an insatiable demand for advanced computing power, and the company’s GPUs are at the heart of this technological shift. As AI applications become increasingly complex, requiring massive data processing and sophisticated machine learning capabilities, these products have become indispensable across industries. The company’s ability to anticipate and meet this burgeoning demand has been a critical driver of its stellar financial performance and soaring market valuation. Its strategic focus on AI chips has not only reinforced its market dominance but has also solidified its reputation as an industry leader in cutting-edge technology.

Unprecedented Stock Price Growth

Nvidia’s stock price has experienced a remarkable surge, rising by over 170% this year alone. This growth is driven by Nvidia’s pivotal role in the generative AI boom. The company’s stock has multiplied more than ninefold since the end of 2022, reflecting its critical position in the AI technology sector. Nvidia’s first-quarter earnings report in May exceeded Wall Street’s expectations, posting a record $26 billion in revenue for fiscal year 2025, up 262% from the previous year. Following this impressive earnings report, Nvidia’s stock price opened above $1,000 but was later adjusted through a strategic 10-for-1 stock split.

The surge in stock price is not merely a reflection of past successes but also a strong indicator of investor confidence in the company’s future. Consistent delivery of robust financial results has made it a favorite among investors. Furthermore, the decision to implement a 10-for-1 stock split has made the shares more accessible to a broader base of investors, further fueling the stock price growth. This strategic move not only democratized ownership but also signaled the long-term growth potential, making it an attractive option for both institutional and retail investors.

From Gaming to AI Powerhouse

Nvidia’s origins lie in the gaming industry, where it initially focused on developing hardware solutions such as graphics cards, cryptocurrency mining chips, and cloud gaming subscriptions. However, over the past few years, it has undergone a dramatic transformation, pivoting towards AI technology—a move that has significantly boosted market valuation. AI chips, particularly the Hopper and its highly anticipated successor, Blackwell, have been pivotal in training and running some of the world’s most sophisticated AI models. These innovations have not only contributed significantly to revenue but have also reinforced the company’s position as a leader in the AI chip market. The roadmap for the future includes the introduction of the Blackwell Ultra chip in 2025 and the Rubin AI platform in 2026, both of which are expected to further cement its dominance in the AI sector.

The evolution from a gaming-focused company to a global leader in AI technology is a remarkable story of innovation and strategic foresight. Early successes in the gaming industry laid the foundation for later achievements in AI. By leveraging expertise in high-performance computing, it has been able to develop cutting-edge AI chips that are now the backbone of numerous AI applications, from autonomous vehicles to advanced data analytics. The forthcoming Blackwell Ultra chip and the Rubin AI platform are poised to set new industry standards, underscoring the company’s commitment to maintaining its leadership position in the rapidly growing AI market.

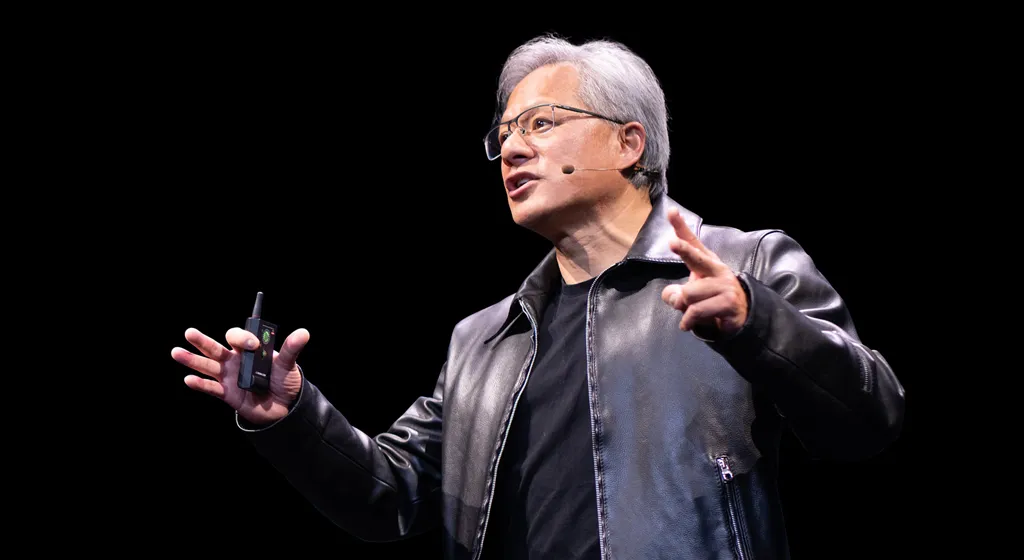

CEO Jensen Huang’s Rising Net Worth

Nvidia’s CEO, Jensen Huang, has seen his net worth climb to $117 billion, making him one of the wealthiest individuals globally. This reflects the company’s stellar performance and its critical role in the ongoing AI revolution. Nvidia’s ascent has been so rapid that the company has yet to be added to the Dow Jones Industrial Average, an index comprising 30 of the most valuable U.S. companies. The recent stock split has improved its chances, as the Dow is a price-weighted index, meaning companies with higher stock prices have a greater influence on the benchmark.

Jensen Huang’s leadership has been instrumental in Nvidia’s rise to the top. His vision and strategic direction have guided the company through its transformation from a niche gaming hardware manufacturer to a leading player in the AI industry. Huang’s ability to foresee market trends and position Nvidia to capitalize on them has been a key driver of the company’s success. His rising net worth is a testament to his effective leadership and the company’s outstanding performance.

The Future of Nvidia

In conclusion, Nvidia’s rapid rise underscores its pivotal role in the AI technology sector. With its market cap surpassing $3.34 trillion, Nvidia has solidified its position as the world’s most valuable public company. As the demand for AI technology continues to grow, Nvidia’s dominance in the AI chip market positions it well for sustained future growth. The company’s innovative edge and strategic market positioning make it a crucial player in the ongoing technological revolution.

Looking ahead, Nvidia is well-positioned to continue its growth trajectory. The company’s focus on innovation, coupled with its strong market position, provides a solid foundation for future success. As Artificial Intelligence technology continues to evolve and become more integrated into various industries, the demand for Nvidia’s high-performance AI chips is likely to increase. The company’s commitment to developing new products and expanding its market reach will ensure that it remains at the forefront of the AI revolution. Nvidia’s journey is a compelling example of how innovation and strategic vision can drive extraordinary growth and transformation in the technology industry.