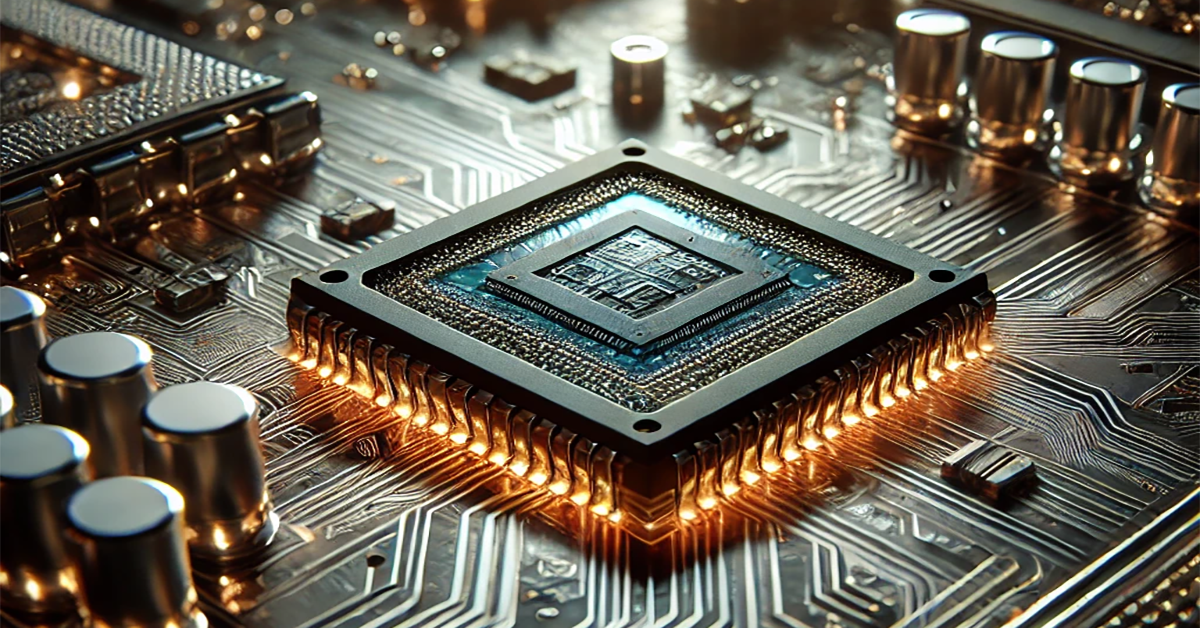

- Nvidia Blackwell AI Chip Driving Record Share Prices Amidst TSMC’s Rise: What’s Fueling the Chip Giant’s Success?

- Nvidia’s Stock Surge: Record High and the TSMC Connection

- The Blackwell AI Chip: Nvidia’s Next Game Changer

- The Future of AI: Why Blackwell is So Important

- Nvidia and AI’s Global Dominance

- TSMC’s Role in Enabling Nvidia’s Blackwell Chip Success: A Deeper Look

- Conclusion: What’s Next for Nvidia?

Nvidia Blackwell AI Chip Driving Record Share Prices Amidst TSMC’s Rise: What’s Fueling the Chip Giant’s Success?

Nvidia is riding high once again, with its shares soaring to a record level, bolstered by the impressive results of Taiwan Semiconductor Manufacturing Company (TSMC). Nvidia’s Blackwell AI chip driving record share prices has been a major contributing factor to this growth. Nvidia’s Blackwell AI chip driving record share prices is helping to shape investor confidence and drive market interest.

Nvidia’s Blackwell AI chip driving record share prices has been a major contributing factor to this growth. The buzz around Nvidia isn’t limited to its stock performance—the much-anticipated Blackwell chip has the tech world at the edge of their seats. Nvidia’s Blackwell AI chip driving record share prices is creating significant anticipation and driving tech enthusiasts to closely follow the company’s progress. But what is behind this upward trend, and what does the future hold for Nvidia as it continues to lead the AI revolution? The Nvidia Blackwell AI chip driving record share prices is one of the pivotal elements behind this surge.

In this article, we dive into the factors driving Nvidia’s growth, the TSMC connection, and what the new Blackwell AI chip means for both Nvidia and the broader technology industry. In this article, we will explore how Nvidia’s Blackwell AI chip driving record share prices is impacting the market, Nvidia’s relationship with TSMC, and the future of the broader tech industry. We will explore how the Nvidia Blackwell AI chip driving record share prices is impacting the market, alongside Nvidia’s relationship with TSMC and the broader tech industry.

Nvidia’s Stock Surge: Record High and the TSMC Connection

Nvidia’s shares reached a new intraday high of $140.89, surpassing its previous peak set in June, and eventually settled at $136.93 by the end of trading. The Nvidia Blackwell AI chip driving record share prices has played a significant role in this rise, along with the support from TSMC’s performance. This spike came in part due to TSMC’s stellar third-quarter results. This spike was significantly influenced by Nvidia’s Blackwell AI chip driving record share prices and TSMC’s stellar third-quarter results. The semiconductor giant reported a 54% profit increase, well above market expectations, and witnessed its market capitalization soar past $1 trillion.

As Nvidia is one of TSMC’s key customers, the fortunes of both companies are closely intertwined. This symbiotic relationship ensures that any boost in TSMC’s prospects often reflects positively on Nvidia’s stock as well. Dan Coatsworth, an analyst at AJ Bell, highlighted this correlation, emphasizing that TSMC’s results act as a direct read-across for Nvidia.

TSMC: A Bellwether for the Semiconductor Industry

TSMC’s influence stretches beyond Nvidia, providing chips for other tech giants like Apple and AMD. The company’s Q3 earnings report reflected a surge in demand for advanced chips—an encouraging sign not only for Nvidia but also for the entire semiconductor industry. TSMC’s success is often seen as a leading indicator of the health of the sector, which is crucial in driving the evolution of consumer technology and enterprise solutions.

Investors were quick to note TSMC’s success, and the subsequent rise in Nvidia’s stock demonstrates the interconnected nature of tech suppliers and manufacturers. For investors eyeing the semiconductor industry, TSMC remains a bellwether, offering insight into broader market trends.

The Blackwell AI Chip: Nvidia’s Next Game Changer

Nvidia isn’t only making headlines for its stock price. Nvidia’s Blackwell AI chip driving record share prices is making headlines across the industry, driving investor enthusiasm. Nvidia’s Blackwell AI chip driving record share prices is also a major talking point in the industry. The company’s upcoming Blackwell AI chip is generating significant excitement across the industry. The Nvidia Blackwell AI chip driving record share prices is generating significant excitement across the industry, positioning it as a game-changing development in the AI market. In a recent interview, Nvidia’s CEO Jensen Huang described the demand for the Blackwell AI GPU as “insane,” with orders expected to bring in billions in revenue during the fourth quarter.

Blackwell is expected to be priced at around $30,000 to $40,000 per unit, making it a high-end choice for enterprises pushing the boundaries of artificial intelligence and deep learning. According to Huang, “Everybody wants to have the most and everybody wants to be first,” which speaks volumes about the impact Blackwell is anticipated to have in the market.

A Strategic Partnership with Foxconn

Adding to the excitement is Nvidia’s partnership with Foxconn, the largest contract electronics manufacturer in the world. Foxconn is set to construct massive AI factories in collaboration with Nvidia, focusing on manufacturing the GB200 superchips. One of these colossal facilities will be built in Mexico, with Foxconn chairman Young Liu describing it as “very, very enormous.”

This strategic collaboration signals Nvidia’s commitment to scaling up its AI capabilities globally. Partnering with Foxconn not only ensures the availability of cutting-edge infrastructure to support Nvidia’s ambitious goals but also showcases Nvidia’s influence in shaping the future of AI technology.

The Future of AI: Why Blackwell is So Important

Nvidia’s investment in Blackwell is part of a broader push to dominate the AI GPU market. The Nvidia Blackwell AI chip driving record share prices highlights the company’s broader push to dominate the AI GPU market. The Nvidia Blackwell AI chip driving record share prices highlights the company’s broader push to dominate the AI GPU market and strengthen its leadership in AI-driven innovations. As machine learning, data science, and artificial intelligence grow at an exponential rate, GPUs are the backbone of the computing infrastructure powering this revolution.

The Blackwell chip represents Nvidia’s vision of addressing the growing demand for more powerful AI computing. It is aimed at sectors such as advanced research, AI development, and high-performance computing, where speed and efficiency are critical.

Blackwell’s Pricing and Market Position

With a price tag of up to $40,000 per unit, the Blackwell chip is positioned for large enterprises and organizations willing to invest heavily in advanced AI capabilities. For context, Blackwell’s predecessors, such as the Ampere and Hopper chips, were already popular among data centers and tech companies looking to accelerate AI-driven initiatives. Blackwell aims to take this to the next level with higher computing capabilities and enhanced power efficiency.

Nvidia and AI’s Global Dominance

Nvidia’s ongoing innovations position it at the heart of the global AI movement. It isn’t just about making chips; Nvidia’s ecosystem, which includes software solutions like CUDA and a strong portfolio of hardware, makes it the leader in enabling artificial intelligence solutions at scale.

With the upcoming Blackwell chip and new manufacturing partnerships, Nvidia seems to be setting itself up to drive global AI adoption. Whether it’s about training complex machine learning models or powering data centers that handle immense volumes of data, Nvidia is clearly striving to be the leading force. The Nvidia Blackwell AI chip driving record share prices is integral to this vision, ensuring Nvidia remains the leader in training complex machine learning models and powering advanced data centers.

TSMC’s Role in Enabling Nvidia’s Blackwell Chip Success: A Deeper Look

To further enhance the understanding of Nvidia’s Blackwell AI chip’s impact, it’s crucial to explore TSMC’s pivotal role in making this groundbreaking hardware possible. As the world’s largest contract semiconductor manufacturer, TSMC plays an essential role in producing the cutting-edge chips that power Nvidia’s AI solutions.

Advanced Manufacturing Nodes Driving Innovation

The Blackwell AI chip leverages TSMC’s advanced 3nm and 5nm process nodes, which provide unparalleled performance and power efficiency. These cutting-edge nodes allow Nvidia to deliver more transistors in a smaller footprint, resulting in faster processing speeds and lower energy consumption—two critical factors for AI workloads.

Supply Chain Resilience and Scalability

TSMC’s robust manufacturing capabilities ensure Nvidia can meet the surging demand for Blackwell chips. By maintaining a consistent and scalable supply chain, TSMC helps Nvidia cater to industries ranging from cloud computing to autonomous vehicles. This partnership is vital as Nvidia aims to dominate the AI chip market and address the growing needs of enterprise customers.

Collaborative Innovation for Future Growth

Nvidia and TSMC’s collaborative efforts extend beyond hardware manufacturing. Both companies are investing in research and development to push the boundaries of semiconductor technology, ensuring the next generation of AI chips continues to deliver groundbreaking performance.

Conclusion: What’s Next for Nvidia?

Nvidia’s recent surge in share value and the excitement surrounding the Blackwell AI chip highlight the company’s promising future. Nvidia’s Blackwell AI chip driving record share prices, along with the recent surge in share value, highlights the company’s promising future. Nvidia’s Blackwell AI chip driving record share prices and the recent surge in share value underscore the company’s promising future. With the continued support from partners like TSMC and Foxconn, and the anticipation of its revolutionary AI hardware, Nvidia looks poised to maintain its leadership in both AI and the wider semiconductor industry. Nvidia’s Blackwell AI chip driving record share prices solidifies its leadership in AI and positions the company to lead the wider semiconductor industry.

If you are an investor, keeping an eye on Nvidia’s progress, particularly with the rollout of Blackwell, might present some unique opportunities. Meanwhile, tech enthusiasts can look forward to a more robust future in AI, with Nvidia leading the charge.

Want to stay updated on the latest in technology, AI, and Nvidia’s groundbreaking innovations? Share this article with your peers and don’t forget to explore our other articles on AI and the future of semiconductors!